WELCOME TO VITA! FREE TAX HELP YOU CAN TRUST!

The Volunteer Income Tax Assistance (VITA) program, offered by United Way of West Florida, provides free, reliable tax preparation for hardworking individuals and families with an income level of $69,000 or less. Our IRS-certified volunteers are here to help you file your taxes accurately, securely, and at no cost. Allowing you to keep more of what you’ve earned. Whether you’re a student, a senior, or working to support your family, VITA is designed to serve you.

Click HERE to book an appointment now!

Want to know if you qualify, what to bring, or where to find a site? Keep reading to learn how VITA can make tax season easier for you.

VITA SITES: Feb. 1 to Apr. 15

Monday:

- Pensacola State College-Warrington Campus: 1:00 pm – 5:00 pm

Tuesday:

- Pensacola State College-Main Campus: 9:00 am – 7:00 pm

Wednesday:

- Pensacola State College-Warrington Campus: 9:00 am – 2:00 pm

- Pensacola State College-Main Campus: 1:00 pm – 7:00 pm

Thursday:

- Pensacola State College-Milton Campus: 1:30 pm – 6:00 pm

Friday:

- Goodwill Gulf Coast (1715 E Olive Rd): 10:00 am – 2:00 pm

- Pensacola State College Main Campus: 1:00 pm – 7:00 pm

Saturday:

- Pensacola State College-Century Campus: TBD

- Florida Blue Center (1680 Airport Blvd)

- February 14, 21, 28

- March 7, 28

- April 11

We ask that taxpayers arrive 15 minutes early to their appointment to complete their intake form.

VITA generally serves individuals and families with a household income of $67,000 or less. The program is also designed to support seniors, people with disabilities, and taxpayers with limited English proficiency. Eligibility is determined based on income and the type of tax return needed.

Yes. Taxpayers who are not U.S. citizens may be served through VITA if they have an Individual Taxpayer Identification Number (ITIN). VITA cannot file a return without a valid Social Security number or ITIN.

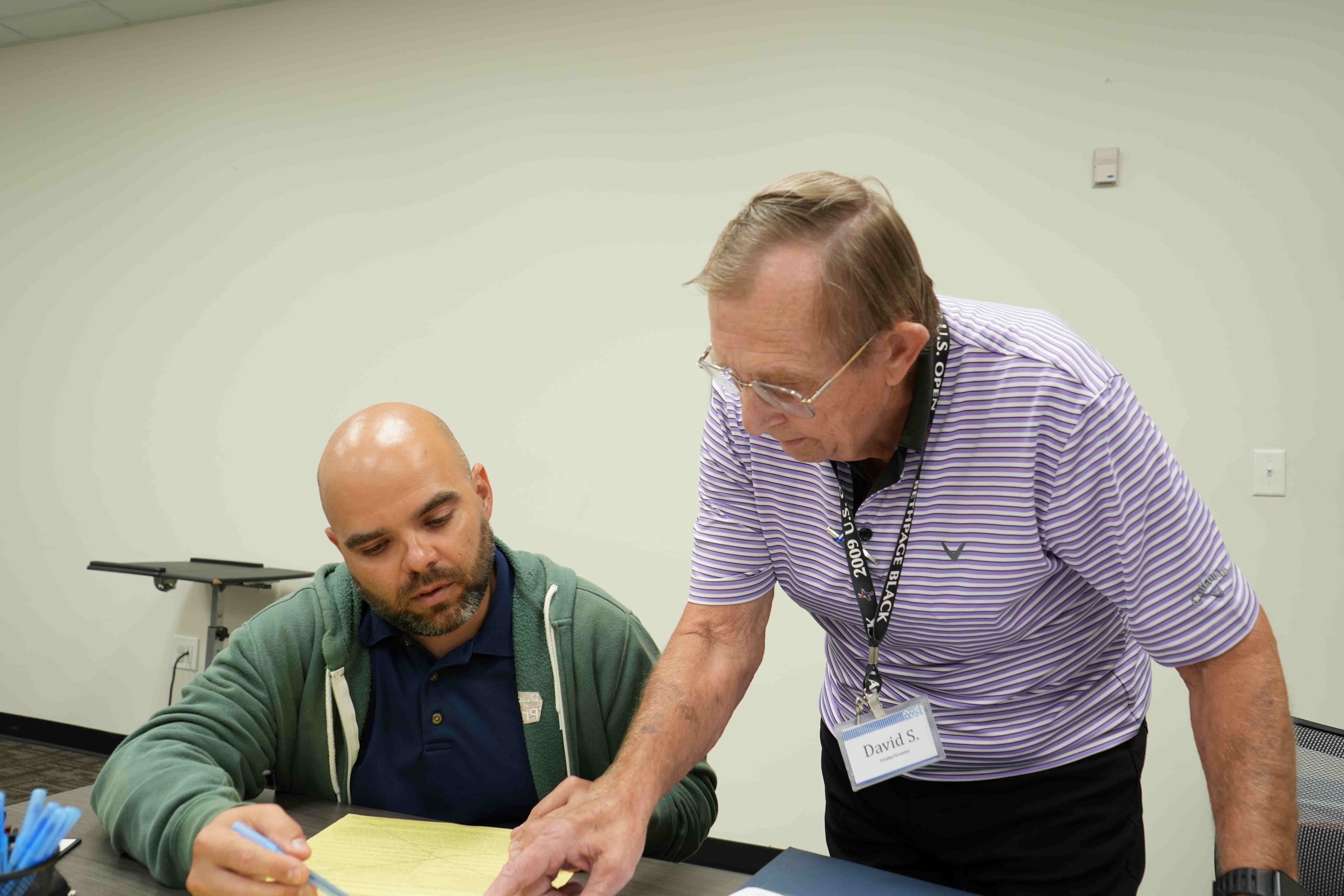

Your tax return is prepared by IRS-certified volunteers who have completed required training and testing. Every return is reviewed for accuracy before it is filed. All volunteers follow strict confidentiality and privacy standards.

Yes. Appointments are required to receive tax preparation services through VITA. Appointment scheduling opens in mid-January, and the link will be posted on our website when it becomes available.

During your appointment, a volunteer will review your documents, ask questions to better understand your situation, and prepare your tax return based on the information you provide. A second certified volunteer will review the return for accuracy before you sign and approve it for electronic filing. Most appointments take about 60–90 minutes, depending on complexity.

VITA services are offered during tax season, typically February through April, at multiple community locations across Escambia and Santa Rosa counties. Locations, days, and times vary by site.

Monday:

- Pensacola State College-Warrington Campus: 1:00pm – 5:00pm

Tuesday:

- Pensacola State College-Main Campus: 9:00am – 7:00pm

Wednesday:

- Pensacola State College-Warrington Campus: 9:00am – 2:00pm

- Pensacola State College-Main Campus: 1:00pm – 7:00pm

Thursday:

- Pensacola State College-Milton Campus: 9:00am – 6:00pm

Friday:

- Goodwill Gulf Coast (1715 E Olive Rd): 10:00am – 2:00pm

- Pensacola State College Main Campus: 1:00pm – 7:00pm

Saturday:

- Pensacola State College-Century Campus: February 7, April 6

- Florida Blue Center (1680 Airport Blvd):

- February 14, 21, 28

- March 7, 28

- April 11

Please review our appointment checklist to ensure you are fully prepared.

VOLUNTEER

Help reVITAlize our community as a VITA volunteer!

VITA volunteers receive free IRS training and help provide accurate, no-cost tax preparation for hardworking individuals and families in our community. You can learn more about volunteering here

FILE YOUR TAXES ONLINES WITH MYFREETAXES

If you’re comfortable preparing your own taxes, myfreetaxes.com is a free, secure online filing option supported by United Way and the IRS. It allows most individuals earning $89,000 or less to prepare and file their federal and state tax returns at no cost, from anywhere, with step-by-step guidance.

No appointment is required. Visit myfreetaxes.com to get started

If you have any questions about the program or need help scheduling an appointment, please contact us at vita_appt@uwwf.org or call 850-434-3157. Our team is happy to assist you!

VITA is funded through grants awarded to United Way of West Florida by the Florida Department of Economic Opportunity, Internal Revenue Service, and United Way Worldwide. Florida Blue, Pensacola State College, University of West Florida, and GoodWill Gulf Coast provide additional support.